ATECRAM CAPITAL

Empowering Your Trading Journey.

Asset management

We offer professional asset management focused on long-term capital growth and active portfolio management across global financial markets.

Our approach is based on disciplined risk management, data-driven decision-making, and a deep understanding of both traditional and modern investment instruments.

The service is provided in the form of discretionary management of client assets in accordance with the applicable legal framework.

About us

Extensive experience

We have over 10 years of experience across a wide range of financial markets, including options, futures, stocks, commodities, and cryptocurrencies

Above-average returns

Our strategies have consistently delivered above-average returns compared to traditional markets and instruments such as stocks and commodities.

Diversified portfolio

We manage a diversified portfolio. While we strive for high returns, diversification helps us keep risk at a reasonable level.

Robust strategy

We use proven methods and strategies based on sophisticated models employed by top traders in the industry.

Performance vs. Risk

We focus on maximizing returns while minimizing risk. Strict risk management and money management rules are the foundation of our approach to capital protection.

Efective timing

We time our entries and exits with maximum precision. Our decisions are guided by market structure, value areas, and cyclical trends—executing trades with surgical accuracy.

How it works?

1. Meeting the minimum Requirements

The minimum investment amount is set at 125 000 EUR. Both individuals and legal entities from the EU are eligible to invest.

2. Online or In-Person Meeting

After completing the contact form, we will schedule a meeting to walk you through how our asset management service works, including our investment approach, risk management framework, and contractual terms.

3. Signing the Management Agreement

If both parties reach mutual agreement, an asset management agreement will be concluded. The agreement may be signed either in person or remotely.

4. Capital allocation

After the agreement is executed and the funds are credited, we begin allocating capital within the managed portfolio. Capital is allocated across investment and trading strategies with the objective of achieving long-term capital appreciation under controlled risk.

5. Periodic reporting

We provide regular updates through clear, concise, and transparent reports on activities within the managed portfolio and the development of the value of your investment.

6. Funds withdrawal

You can request a withdrawal of your funds at any time. Along with the payment, we will also provide all the necessary documents for your tax filing.

Our results

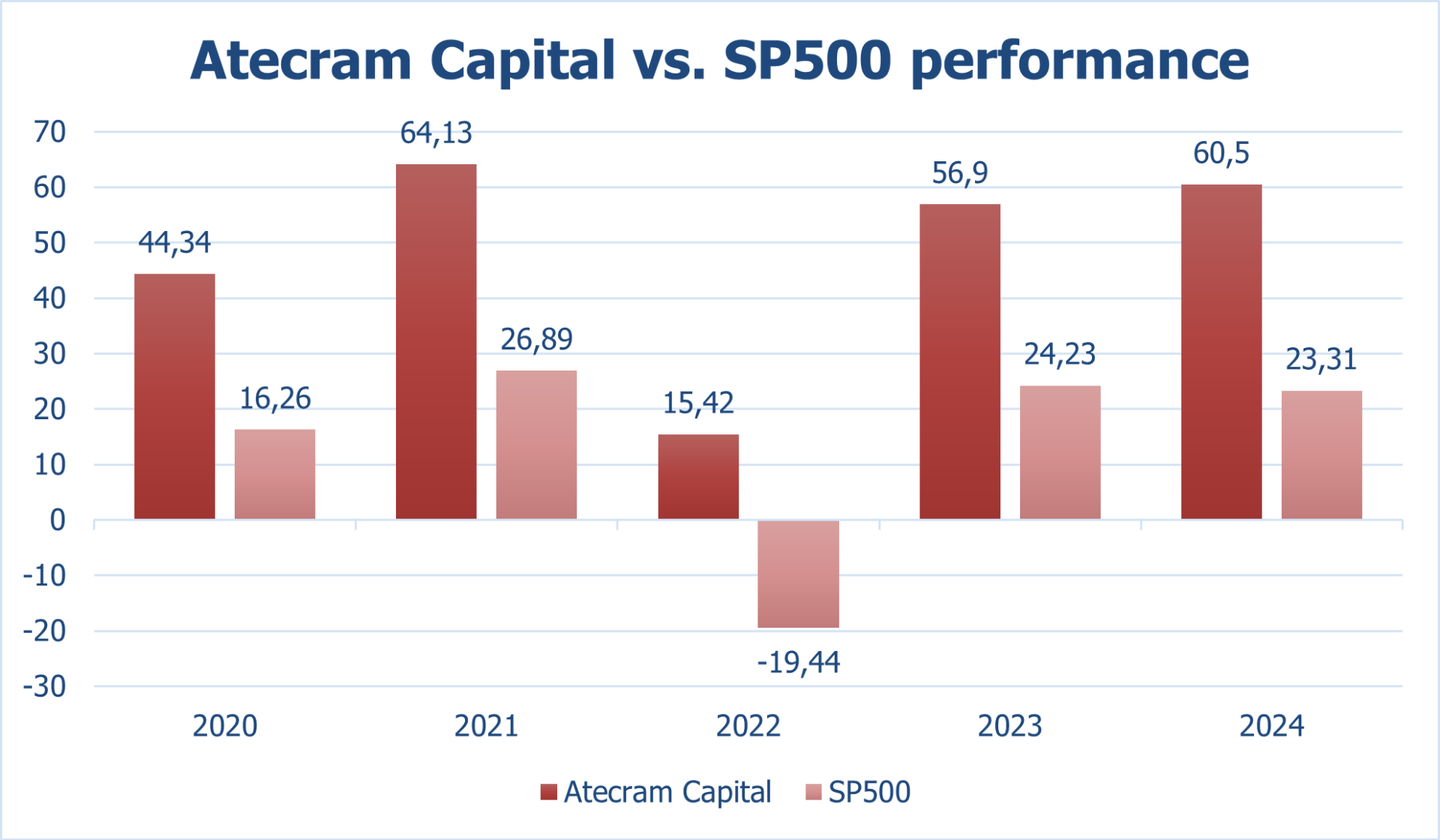

Below you can review the performance achieved by the manager and its legal predecessors compared to the S&P 500 index. The performance figures are presented without taking compound interest into account; in the case of multi-year investing, overall profitability increases significantly due to compounding.

Year by year results:

2020: +44,34%

2021: +64,13%

2022: +15,42%

2023: +56,90%

2024: +60,50%

2025: +40,72%

Investing strategy

Atecram Capital focuses on active asset management that combines long-term investing with short-term trading strategies.

The ability to work with both intraday trading and a long-term investment horizon provides significant flexibility and allows us to respond effectively to varying market conditions.

For intraday trading, we focus on:

CFDs

Futures

For long-term investments, we utilize:

-

Commodities

Cryptocurrencies

-

ETFs and ETCs

Options

Stocks

By combining short-term and long-term strategies, we are able to flexibly adjust the portfolio structure to current market conditions while aiming to maximize returns through disciplined risk management.

Contact form

Are you interested in our services or do you have any questions? If so, please fill out the contact form, and we will get back to you as soon as possible. Alternatively, you can contact us directly at capital@atecram.com.